Economic indicators in Forex

As it is known, a currency rate is affected by many factors. The largest group is formed by economic ones, which can be interpreted with the help of indicators regularly published in Forex.

The list of economic indicators in Forex includes great domestic product, producer price and consumer prices indexes, unemployment rate, dynamics of housing building, business activity index, etc.

Why do we need to analyze Forex economic indicators?

It is useful to analyze economic indicators in exchange market for several reasons regardless of an investor’s trading type.

- Classification the indicators by their importance enables to forecast a quotation movement; a surge in the rate after a renewed indicator release can reach 200 points and more in just a few hours.

- News background has a direct influence on the rate dynamics and often contradicts technical indicators. Such a disparity can cause losses which could have been avoided.

- The understanding of economic processes allows to feel the market better.

- It should be borne in mind that traders reacting to the economic indicators release analyze the secondary information. This information has been given them by the news companies, which have got it from special agencies calculating the major indicators. The market do not always changes its course after such news release but it always becomes more active.

Peculiarities of the Forex economic indicators analysis

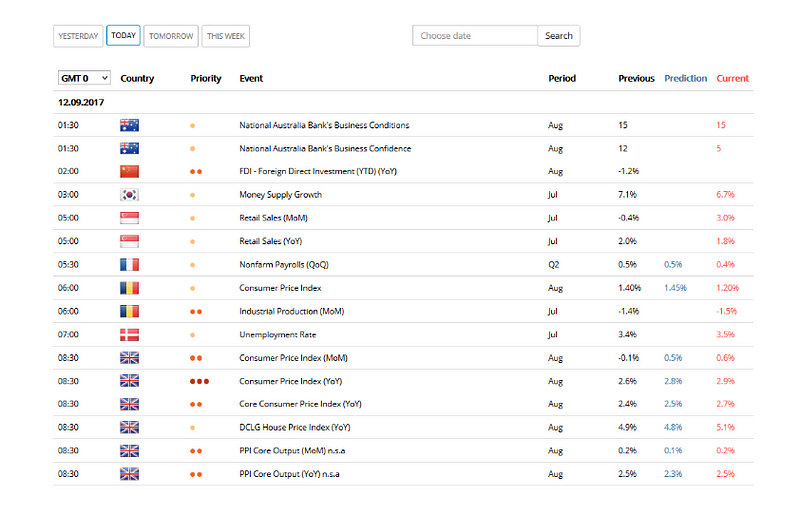

As a rule, the indicators of those currencies are followed which form a trader’s portfolio. Almost always it includes the USA dollar, Japanese yen and the pound sterling. All the most important indicators are presented in Forex economic calendar and this considerably simplifies trader’s work.

A list of planned economic events

The indicators with current values significantly different from predicted ones have the greatest influence on the market. For example, expecting the Bank of Canada not to change the interest rate, traders are not going to carry out any speculation or revise the rate dynamics. However, if the rate is reduced, the upward trend is likely to start in the market.

The following indicators have the greatest influence on the market:

- Indicators of general economic performance of the country. (GDP and GNI, consumer prices and production prices indexes, inflation level, interest rate, export surplus);

- index of employment (unemployment rate, jobless claims);

- Index number of industrial production (business activity index, industrial production index, amount of nonfarm payrolls, volumes of housing construction, volume of durable goods orders)

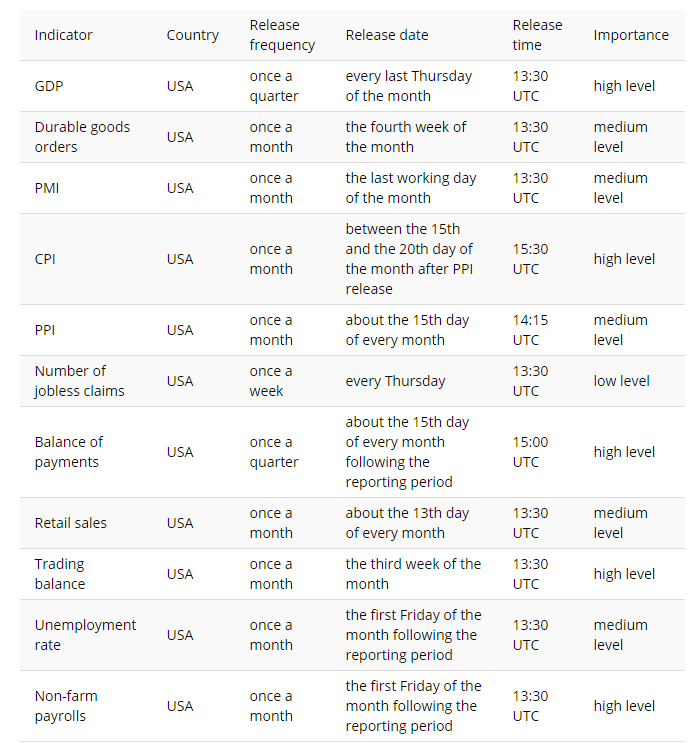

The major indicator is gross domestic product. All the other data are interpreted from the point of view of if there are any economic problems and what influence they will have on the production level. GDP is released quarterly, and the predictions of its dynamics are renewed every month.

Gross domestic product is the total value of everything produced by all the people and companies in the country during a certain period of time. One of the most well known ways of GDP calculations is by the expenditures. According to it, GDP is a sum of personal consumption expenditures, government spendings, business investment and net export (the difference between export and import). Such a structure allows to see that GDP growth should not always be interpreted positively. When it grows due to the growing government spendings a currency rate can easily go down. This is because the list of such costs includes military spendings which further can destabilize the economy in the country.

Gross national income is considered more seldom than GDP but it indicates the volume of production only by the residents of the country. The comparison of GDP and GNI shows who earns more, residents of the country working outside the country or non- residents, whose companies work inside the state.

Inflation level and correspondingly the rate of the a national currency depreciation can be followed by several indicators; consumer prices index CPI, production prices index PPI and inflation rate.

CPI indicates commodity bundle cost which includes the most necessary goods and services. Production prices index unlike CPI doesn’t include retail margin or imported goods prices. Every month this indicator shows the rise of prices for semi-finished products, components and end products.

Interest rate, which is determined by the central bank, is the indicator the economic situation in the country.

If inflation growth is accompanied by interest rate rise, a country’s economy is likely to have middle-term or short-term problems which can’t be solved by market force. From investors’ point of view, the increasing of interest rate causes a currency appreciation, its reduction causes a national currency depreciation.

Trade balance indicates the ratio of imported foreign goods volume to that of exported goods.

If a country’s export exceeds its import, a national currency is strengthened and vice versa. The dynamics can be analyzed through export surplus. Sometimes the dynamics of import and export prices and current account deficit is used for analysis.

Employment indexes

When analyzing a country’s economy the attention should be paid to unemployment rate and the number of jobless claims. Although the indicators are lagging they allow to know the state of economy more thoroughly. Unemployment rate is the ratio of unemployed people in a country to the labour force. It includes only people who are interested in finding work, except for students, those not working on principle, etc. Weekly release of jobless claims number allows to rapidly assess in dynamics employment rate. It should be borne in mind that this indicator is subjected to seasonal fluctuations, that is why it is more often used as reference information and doesn’t raise volatile swings in the markets.

The best known and the most significant indicator, which is the base of some trading strategies on news, is Non-farm payrolls. It is the number of people employed in nonfarm sector.

The indicator embraces more than ¾ of all employment in the USA, but doesn’t include those who are employed in agriculture, government structures, private household and non-profit sector. The indicator representative because the employment growth causes the rise of population income. This in its turn causes consumer expenditures which influences GDP.

Release calendar of the basic economic indicators for the USA dollar

Industrial production indicators

The base of any country’s economy is its industrial sector. For its assessment both objective quantitative data (PPI — industrial production index) and subjective survey based date (PMI -non-manufacturing business activity index) can be used.

Industrial production index indicates the total output of all manufacturing of industrial sector.

This indicator is often used as a leading one for GDP; it used for the predictions of GDP dynamics.

Non-manufacturing business activity index is based on surveys of purchasing and supply managers who answer the questions about new orders, production land employment levels, amounts of materials supply and stock. The response options are “better”, “unchanged”, “worse”. The sum of replies is interpreted to the a scale of 0 to 100. The indicator’s positive dynamics compared to the previous periods is interpreted positively by markets, and the negative dynamics causes a decline in a currency rate.

Industrial production indicators can indirectly attribute such factors as retail sales dynamics, volumes of new housing construction and durable goods orders.

The interpreting of all three indices is the same, the more money consumers are ready to spend at the moment, the higher their expenditures are. Furthermore, expenditures growth means that buyers assess the development prospects positively and expect their financial condition to improve further in future.

Read more interesting stories, reviews and analyses on the LiteForex Traders Blog: https://www.liteforex.com/blog/

Comments

Post a Comment