Monero looks better than the market and has a strong foundation. When should we go long?

Dear friends,

The market is still now, all cryptocurrencies are trading flat; that means, there will be a new momentum and new strong moves soon.

For those, who like to be prepared in advance, it is a good time now to determine their trading plans and start considering the personal portfolio structure.

So, I would like to attract your attention to Monero.

I have been interested in this token for a long time, for its chart looks the most promising, compared to the generally the negative cryptocurrency market.

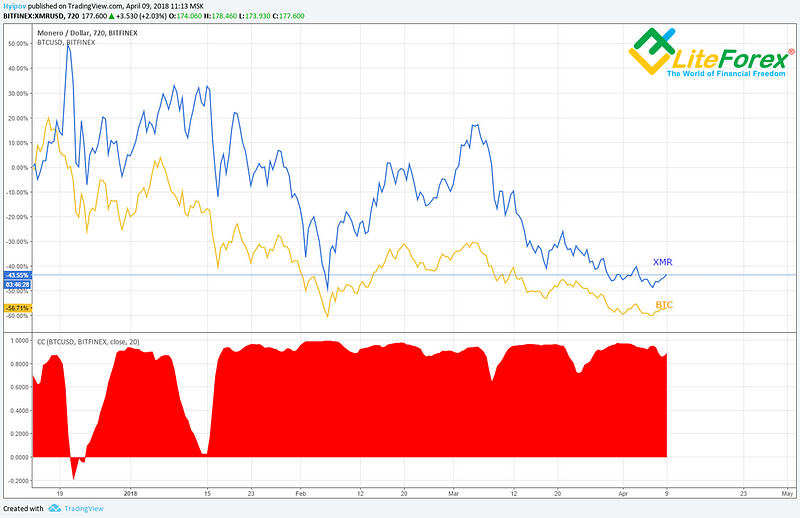

As it is clear from the last analysis of Bitcoin/Monero correlation, Monero is strongly supported

Although, the correlation with Bitcoin has been driving at figure 1 for a long time, we see that each try of the BTC bullish retracement results in another surge in the XMR price

In general, it is a good sign, allowing us to assume that, in case of bullish market reversal, Monero will be rising in price very fast.

Fundamental analysis suggests three factors for that:

1. The strongest growth factor for Monero may become Ethereum switching to PoS algorithm

As known, PoS consensus doesn’t support common Graphic cards or ASICS mining. After this shift, everybody, who has been mining Ethereum, will switch to other altcoins.

2. Monero protection from Industrial ASIC Applications.

The last Monero fork, that is progressing just now, aims at protecting the token from powerful Bitmain ASICS

I’m sure, this decision is rather a political one and aims at making a courtesy to individual miners, including those, who have been mining ethereum so far. So, this decision has far-reaching effects; and Monero has all the chances to become the public currency, protecting the interests of individual miners.

3. Future series of Monero forks.

The decision to target ASISCs will obviously find its opponents. Some user groups have already called for the coin hard fork and creation of alternative tokens with the same original code.

That can result in emerging of such tokens as Monero Classic and Monero Original.

The coins themselves will hardly find strong support, but any Monero holder will be able to obtain new forks for free. Many advanced users are likely to take part in this party of forks, which will surely increase the demand for the coin.

Let’s switch from fundamental analysis to technical one.

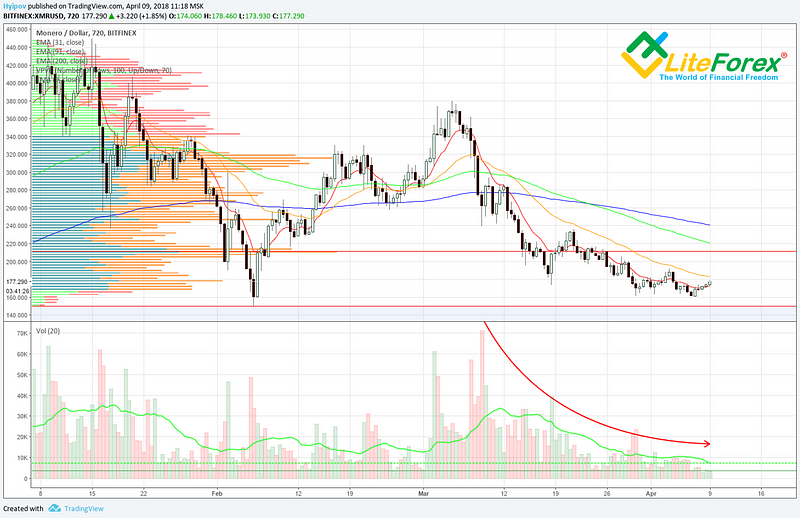

In the chart above, we see that XMR has approached the strong channel’s borders for the second time already.

However, with a more detailed study, we see that the second low failed to reach the values of its elder brother.

It is an extremely positive signal that suggests good support at these levels.

In the ticker volume chart, we see that Monero bearish trend is not supported by the market; that also indirectly suggests a potential rebound.

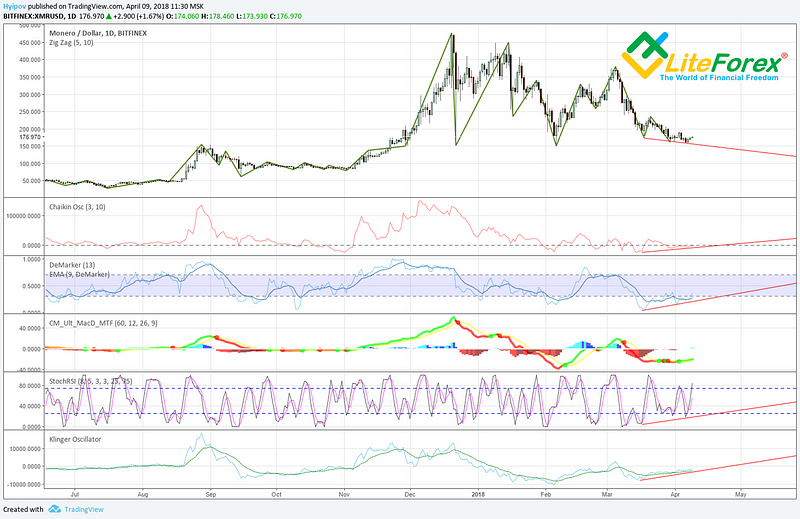

Analysis of oscillators in the daily timeframe shows good potential for reversal. It is suggested by bullish divergence, indicated by almost all oscillators; MACD is also in the green zone. The combination of all these signs provides a good bullish signal.

Before we study Fibonacci levels and apply graphic analysis, it should be noted that, unlike that of other altcoins, the ticker daily chart doesn’t indicate bearish trend, roughly speaking.

In the chart above, we see that Monero is trading in a wide horizontal channel; it is now at the lower channel borders. Moreover, it is clear that 0.232 Fibo extension is still relevant, creating a strong barrier for descending.

If we take a more detailed look, the first clear thing is the wedge (contoured with blue in the chart above).

For now, the price is breaking it out from below. Besides, the breakout is the intersection with Fibonacci arc; which confirms this signal, eliminating all the doubts in its authenticity.

This pattern target is at about 235 USD, however, the rise is not going to be easy.

Considering Bitcoin’s strong influence on the Monero exchange rate, the first modest target, we can assume, is at about 190 USD.

We shouldn’t forget that the price is trading in the local bearish channel, so each long must be carefully considered and can be opened only if there is bullish correction inside the bearish trend.

Reasonably, this scenario can well occur if Bitcoin remains at the level of 6,500 USD and continues with its attempts to reach 7,500 USD (see the chart below).

It should be noted, this forecast is rather optimistic and raises many doubts in the generally negative market, which makes me believe in its relevance stronger.

We all remember that only the minority traders gain, do we???

If this scenario is implemented, the situation for Monero will look like this:

This price is highly likely to roll back to the range of 165–161 USD.

Consolidation at this benchmark will enable bulls to arrange an attack at the level of about 180 USD.

So, my first trading plan is like this:

Buy — 161 SL — 154

TP — 180

You shouldn’t risk more than 5% of the deposit per trade.

Finally, I must warn you that when buying Monero, you should remember that it is an anonymous altcoin.

Taking into account the general tendency for legalizing and regulating cryptocurrency market, all anonymous token can become unpopular and face great restrictions.

So, do always estimate your risks and be especially careful with long-term investment.

I wish you good luck and good profits!

Read more interesting stories, reviews and analyses on the LiteForex Traders Blog: https://www.liteforex.com/blog/

Use a promo-code BLOG to get a bonus from LiteForex:

Comments

Post a Comment